LLC Formation

Form Your U.S. LLC in Minutes

Everything you need to start your U.S. business: LLC registration, EIN, bank account, and registered agent, all in one package.

Trusted by founders, operators, and global businesses in 150+ countries

What's Included

Everything you need in one package

No hidden fees. No upsells. Just a complete LLC formation with everything you need to start accepting payments and running your business.

LLC Formation Package

All-inclusive business formation

How It Works

From signup to operating in days

We handle the paperwork so you can focus on building your business

Choose Your State

5 minutes

Select your state, enter basic business info, and complete checkout.

We File Everything

1-3 business days

We prepare and submit your formation documents so you can start operating quickly.

You're Ready

Instant access

Receive your LLC documents and start operating your business.

Most LLCs formed within 24-48 hours

Simple Pricing

One price. Everything included.

No hidden fees. No surprise charges. Just everything you need to start.

What's included

- LLC Formation (any state)

- Registered Agent (1st year free)

- EIN / Federal Tax ID

- Business Bank Account Setup

100% Refund Guarantee

Not satisfied? Get a full refund, no questions asked.

Accuracy Guaranteed

If we make an error, we'll fix it at no cost.

24-Hour Response

Our support team responds within 24 hours.

Everything you need to form your LLC and start your business.

After the first year, registered agent service is $99/year. State annual report fees vary.

Why StartGlobal

Built for entrepreneurs like you

We've helped thousands of founders from around the world start and run U.S. businesses. Here's why they choose us.

Customer Reviews

Based on 372 reviews

See what founders around the world are saying about their experience

"StartGlobal made forming my LLC incredibly simple. The entire process took less than a week, and their team handled everything from filing to setting up my bank account. Couldn't be happier!"

Sarah Chen

TechFlow Labs · Software/SaaS

🇺🇸 USA

"As a non-US resident, I thought forming an LLC would be impossible. StartGlobal proved me wrong. No SSN required, and they guided me through every step. My US business is now up and running."

Carlos Mendez

Meridian Exports · Import/Export

🇦🇷 Argentina

"The registered agent service is worth every penny. They handle all my compliance documents and keep me informed of deadlines. Professional and reliable."

Priya Sharma

Zenith Consulting · Consulting

🇦🇪 Dubai, UAE

"I was worried about opening a US bank account from Brazil. StartGlobal's team walked me through the entire process remotely. Account opened in just 10 days!"

Lucas Silva

Nova Digital · E-commerce

🇧🇷 Brazil

"Transparent pricing with no hidden fees. What you see is what you pay. After bad experiences elsewhere, StartGlobal's honesty was refreshing."

James Wilson

Atlantic Ventures · Investment

🇬🇧 United Kingdom

"Their support team answered all my questions patiently, even the basic ones. They made me feel confident about starting my US business journey."

Fatima Al-Hassan

Oasis Trading · Retail

🇸🇦 Saudi Arabia

"Got my LLC approved faster than expected. The dashboard kept me updated on every step of the process. Very organized and professional service."

Marco Rossi

Alpine Tech · Software

🇮🇹 Italy

"The operating agreement they generated was comprehensive and tailored to my business. Saved me thousands in legal fees. Highly recommend!"

Anika Patel

Bloom Wellness · Health & Wellness

🇮🇳 India

"StartGlobal made forming my LLC incredibly simple. The entire process took less than a week, and their team handled everything from filing to setting up my bank account. Couldn't be happier!"

Sarah Chen

TechFlow Labs · Software/SaaS

🇺🇸 USA

"As a non-US resident, I thought forming an LLC would be impossible. StartGlobal proved me wrong. No SSN required, and they guided me through every step. My US business is now up and running."

Carlos Mendez

Meridian Exports · Import/Export

🇦🇷 Argentina

"The registered agent service is worth every penny. They handle all my compliance documents and keep me informed of deadlines. Professional and reliable."

Priya Sharma

Zenith Consulting · Consulting

🇦🇪 Dubai, UAE

"I was worried about opening a US bank account from Brazil. StartGlobal's team walked me through the entire process remotely. Account opened in just 10 days!"

Lucas Silva

Nova Digital · E-commerce

🇧🇷 Brazil

"Transparent pricing with no hidden fees. What you see is what you pay. After bad experiences elsewhere, StartGlobal's honesty was refreshing."

James Wilson

Atlantic Ventures · Investment

🇬🇧 United Kingdom

"Their support team answered all my questions patiently, even the basic ones. They made me feel confident about starting my US business journey."

Fatima Al-Hassan

Oasis Trading · Retail

🇸🇦 Saudi Arabia

"Got my LLC approved faster than expected. The dashboard kept me updated on every step of the process. Very organized and professional service."

Marco Rossi

Alpine Tech · Software

🇮🇹 Italy

"The operating agreement they generated was comprehensive and tailored to my business. Saved me thousands in legal fees. Highly recommend!"

Anika Patel

Bloom Wellness · Health & Wellness

🇮🇳 India

Customer Success Stories

See how founders around the world built their US businesses with StartGlobal

David Park

Nexus Analytics

Data Science & AI

"From Seoul to Silicon Valley clients"

How a data scientist launched his AI consulting firm in the US while managing everything remotely from Seoul.

Read case studyElena Volkov

Artisan Collective

Handmade Goods & E-commerce

"Scaling handmade crafts to global markets"

How a craftsperson built a thriving e-commerce business selling to US customers through major platforms.

Read case studyOmar Hassan

Fintech Bridge

Financial Services & Consulting

"Bridging MENA startups to US investors"

How a fintech consultant overcame banking challenges to serve clients across two continents.

Read case studySofia Martinez

Verde Organic

Food & Beverage

"Bringing organic Mexican flavors to America"

How a food entrepreneur built a US distribution network for her organic product line.

Read case studyAbdelhay Alamaldean

ALInnovate

AI Innovation

"Bringing AI solutions from Cairo to global markets"

How an AI entrepreneur built a US-based tech company to serve Fortune 500 clients while operating from Egypt.

Read case studyWeldys Santos

CodeBridge Solutions

Software Consulting

"Scaling Brazilian dev talent to US tech companies"

How a software consultant built a thriving US-based consultancy connecting Brazilian developers with American startups.

Read case studyFAQ

Common Questions

Everything you need to know about LLC formation

An LLC (Limited Liability Company) is a business structure that protects your personal assets from business debts and lawsuits. It combines the liability protection of a corporation with the tax flexibility of a partnership. For international entrepreneurs, a U.S. LLC provides credibility, access to U.S. banking, and a familiar legal structure for doing business globally.

No. Non-U.S. citizens and non-residents can form an LLC in any U.S. state. You don't need a U.S. address, Social Security Number, or visa. We help founders from 150+ countries form their U.S. LLC every day. All you need is a valid ID and basic business information.

For most international founders, Wyoming or Delaware are excellent choices. Wyoming offers no state income tax, strong privacy protections, and low annual fees. Delaware is preferred for businesses planning to raise venture capital due to its well-established business court system. We'll help you choose the right state based on your specific situation.

Most LLCs are approved within 24-48 hours. After state approval, we immediately begin preparing your EIN application and setting up your registered agent service. The entire process, from signup to having your LLC documents, EIN, and bank account, typically takes 1-2 weeks.

Everything you need to start operating: LLC formation and filing, first year of registered agent service, EIN application assistance, business bank account setup assistance, and a custom-generated operating agreement. There are no hidden fees. $599 covers it all.

A registered agent is a person or company designated to receive legal documents and official correspondence on behalf of your LLC. Every LLC is required by law to have one. Our registered agent service provides a U.S. business address, receives and scans documents, and keeps your personal address off public records.

Yes. We partner with banks that allow remote account opening for international LLC owners. You can complete the entire process online with proper documentation. Our team guides you through the application to ensure approval.

After formation, ongoing costs include: registered agent service ($99/year after the first free year) and state annual report fees (varies by state, typically $50-300/year). We send reminders for all deadlines and can handle filings for you. There are no franchise taxes in Wyoming.

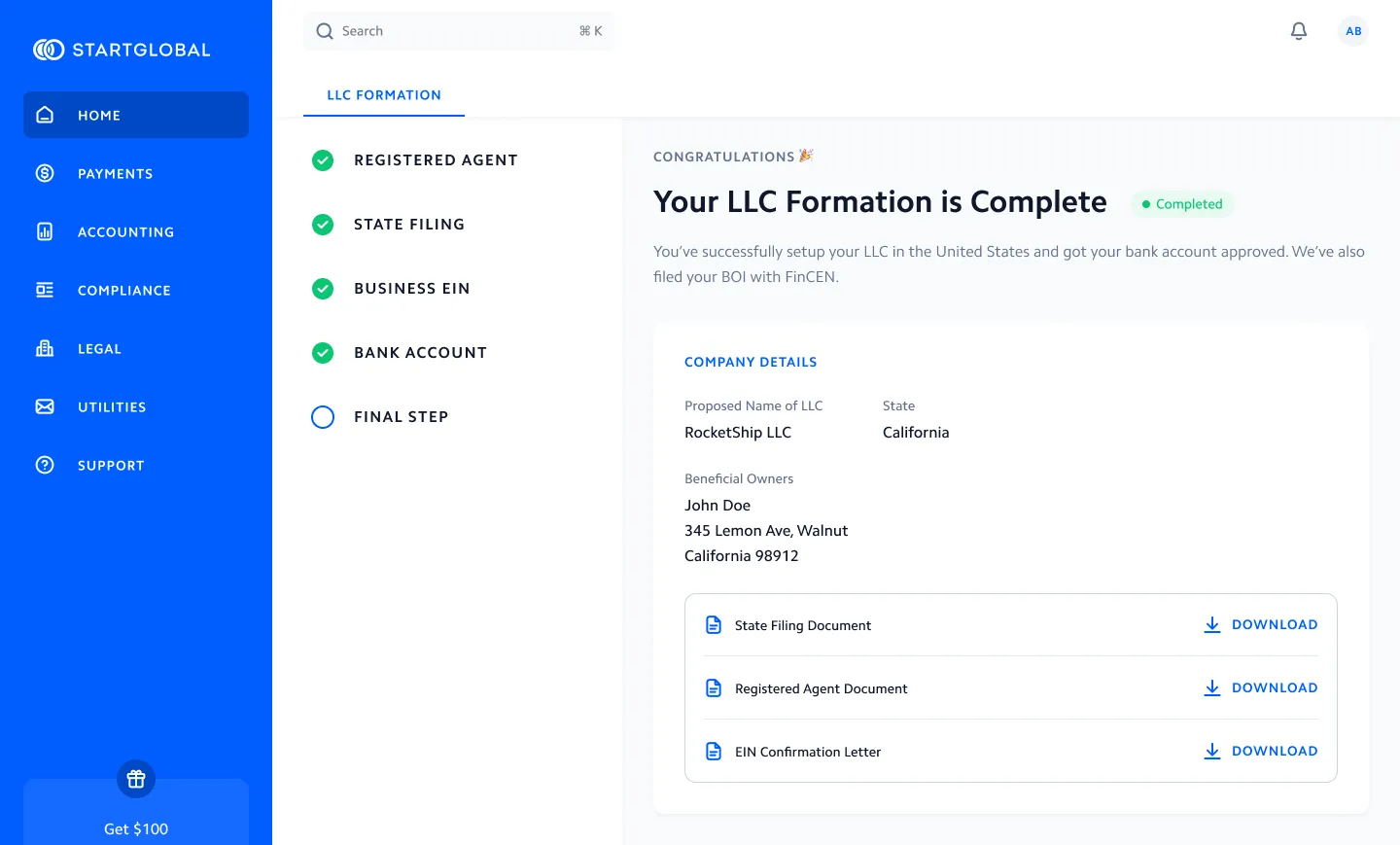

Once approved, you'll receive your Articles of Organization (your official LLC documents). We'll then help you obtain your EIN, open a business bank account, and set up your operating agreement. Your dashboard tracks everything so you always know what's next.

Yes. We use our registered agent address on public filings, not your personal address. Wyoming and Delaware both offer strong privacy protections and don't require listing member names in public records. Your personal information stays private.

Ready to Start Your U.S. Business?

Join thousands of entrepreneurs who trust StartGlobal with their LLC formation. Get started in minutes.