How to Start LLC Quickly in 7 steps

Looking to protect your personal assets and streamline taxes? Start LLC. This guide will walk you through the essential steps and highlight the benefits of forming an LLC.

Key Takeaways

- Forming an LLC provides liability protection for personal assets and tax advantages through pass-through taxation, making it a preferred choice for many entrepreneurs.

- Choosing a business name that complies with state regulations and ensuring the availability of corresponding domain names and social media accounts are crucial for establishing a strong brand identity.

- Maintaining compliance through annual reports, securing necessary licenses, and understanding ongoing costs are essential for keeping the LLC in good standing and operating legally.

Understanding Limited Liability Companies (LLCs)

A Limited Liability Company (LLC) is a business entity that offers liability protection, flexible management, and tax advantages. Forming an LLC safeguards your personal assets from business debts and lawsuits, offering a layer of personal liability protection not available in sole proprietorships or general partnerships. This feature alone makes LLCs a popular choice among entrepreneurs.

One of the key benefits of an LLC is its pass-through taxation. Unlike C corporations, which face double taxation, LLCs allow business income to be passed through to the members, who then report it on their personal tax returns. This simplifies the tax process and can lead to significant tax savings. Additionally, LLCs offer flexibility in management and taxation, which can be tailored to the needs of the owners, making them suitable for a wide range of business types.

LLCs combine elements of different business structures, providing the best of both worlds. They offer the liability protection of a corporation while maintaining the tax simplicity of a sole proprietorship. This unique combination makes LLCs an attractive option for many entrepreneurs. Whether you’re running a single-member LLC or a multi-member LLC, the structure can be adapted to fit your specific needs, providing both protection and flexibility.

Understanding the unique advantages of an LLC is crucial when considering different business structures. Members of an LLC are generally protected from personal risk regarding business debts and lawsuits, providing a significant advantage over sole proprietorships and general partnerships. This liability protection, combined with the tax benefits and operational flexibility, makes forming an LLC a smart choice for many business owners.

Choosing Your Business Name

Choosing the right business name is a crucial step in forming your LLC. A memorable and relevant name can enhance customer recognition and strengthen your business branding. However, the name you choose must also comply with state regulations and be distinguishable from existing registered names within the state. This means conducting a thorough search in your state’s business database to ensure the name is available.

In addition to state regulations, it’s wise to consider domain name availability and social media account names when choosing a business name. Ensuring consistency across all platforms can help establish a strong online presence. If your desired name is not immediately available, many states allow temporary reservation before completing your LLC formation. This can provide peace of mind as you finalize other details.

If your desired legal name is unavailable, you may need to adopt a fictitious name, also known as a DBA (Doing Business As). This can be a practical solution for branding purposes. Additionally, if you’re not ready to file your LLC formation documents just yet, you can reserve the name for a small fee. Taking these steps ensures that your chosen name is protected and ready for use when you are.

Designating a Registered Agent

A registered agent plays a vital role in your LLC’s formation. This individual or service acts as the official contact for your LLC, receiving legal and governmental documents on behalf of the business. The role of a registered agent is not just a formality; it ensures that important documents, such as court summons and government notices, are promptly received and addressed.

Choosing a registered agent is a statutory requirement in all states, and the agent must have a physical address in the state where the LLC is formed. This address cannot be a PO Box, and the agent must be available during normal business hours. While you can act as your own registered agent, many business owners opt to use a professional registered agent service to ensure reliability and compliance.

Failing to maintain a registered agent can lead to serious consequences, including fines and administrative dissolution of the LLC. If you need to change your registered agent, you’ll have to file the appropriate paperwork with the state. Having a reliable registered agent maintains your LLC’s good standing and ensures smooth operations.

Deciding on Management Structure

Deciding on the management structure is a critical step when forming an LLC. There are two primary options: member-managed and manager-managed LLCs. In a member-managed LLC, the owners are responsible for daily operations. They also make the decisions regarding the business. This structure is often more suited for smaller businesses where all members are actively involved in running the business.

On the other hand, a manager-managed LLC allows members to hire managers to handle daily operations, separating ownership from management. This structure can be beneficial for larger businesses or those where not all members wish to be involved in daily management decisions. It allows for a more streamlined decision-making process and can help in managing complex operations.

The right management structure depends on your business’s needs and desired member involvement. For instance, a member-managed LLC might be ideal for a small family business, while a manager-managed LLC could be more suitable for a larger enterprise with multiple investors.

Clearly defining your management structure in your LLC operating agreement can help avoid misunderstandings and ensure smooth operations.

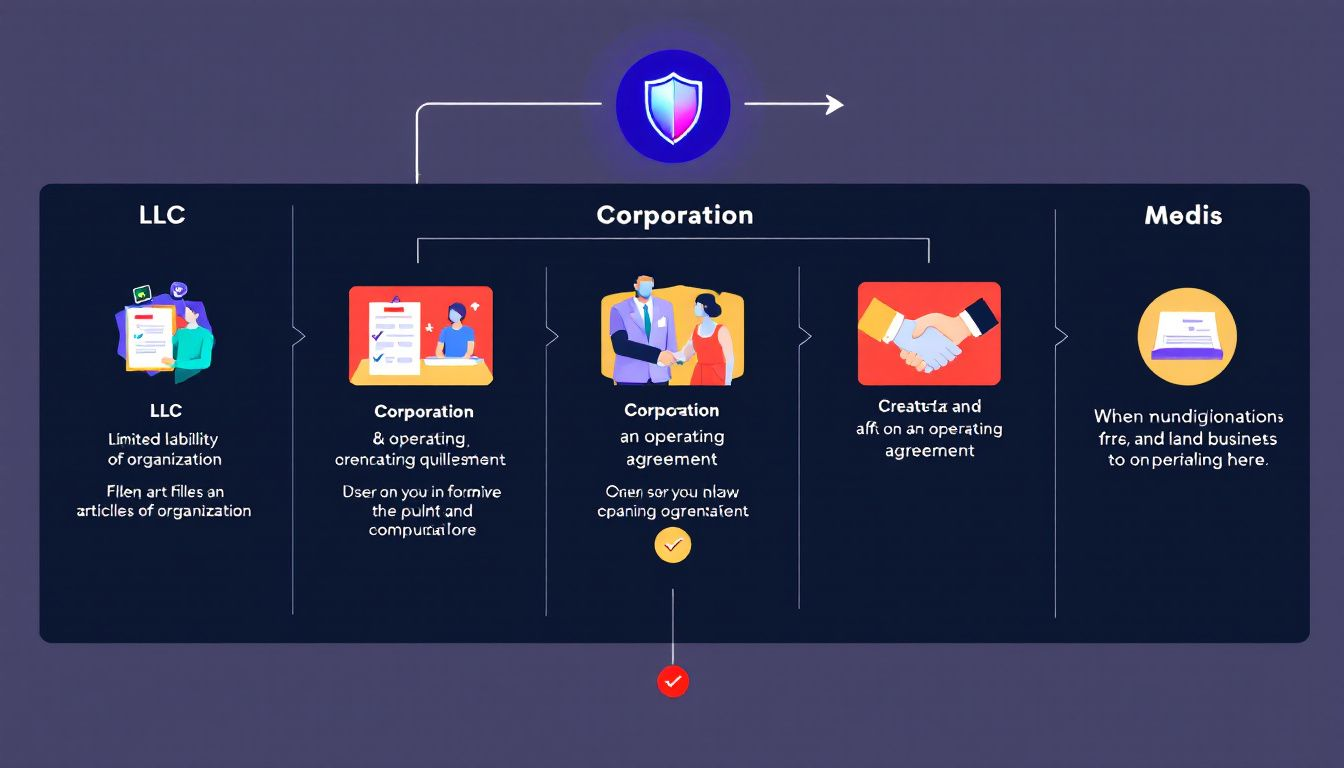

Preparing Your LLC Operating Agreement

An LLC operating agreement is a crucial document acting as a contract between members, clarifying operations and protecting against disputes. It establishes legal separation between the LLC and its members, safeguarding personal assets from business liabilities. Even if your state does not require an operating agreement, having one is highly advisable to outline the internal rules and structure of your LLC.

The operating agreement should clearly define the management structure, whether it is member-managed or manager-managed, to avoid any misunderstandings about control and responsibilities. It should also detail how ownership interests are determined and shared among members, which is critical for preventing future disputes. By addressing these aspects, the operating agreement ensures that all members are on the same page regarding the business’s operations and governance.

Another essential element of the operating agreement is outlining procedures for adding or removing members. This helps maintain stability within the LLC and provides a clear process for changes in membership. Additionally, defining voting rights and decision-making processes within the agreement helps ensure clear governance and smooth operations. These guidelines are crucial for maintaining harmony among LLC members and ensuring that the business operates efficiently.

Finally, the operating agreement should set clear guidelines for profit and loss distribution. This transparency supports trust and cooperation among members, as everyone knows how profits will be shared and losses managed. By addressing these key areas, the LLC operating agreement becomes a foundational document that guides the business’s operations and helps prevent conflicts.

Filing the Articles of Organization

Filing the Articles of Organization is a formal step in establishing your LLC. This document typically includes essential information such as the LLC name, mailing address, registered agent’s name and address, the purpose of the LLC, and the names of the current members or managers. This information is required by the state to officially recognize your LLC as a legal entity.

The filing process involves paying a filing fee, which can range from $50 to $250, depending on the state. Many states offer the convenience of electronic submission, making the process quicker and more efficient. The processing time for the Articles of Organization can vary, ranging from a few days to several weeks. Some states also have additional requirements, such as publishing a notice of formation in a local newspaper.

Once the Articles of Organization are filed and approved, your LLC is officially recognized by the state. This step is crucial for establishing your LLC as a separate legal entity, which provides liability protection and other benefits. Accurate and complete information helps avoid delays and ensures a smooth formation process.

Obtaining an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is necessary for LLCs for tax purposes and is required if the LLC has multiple members or employees. The EIN is used for federal tax purposes, and you will need it to open a business bank account, file tax returns, and apply for business licenses. The process of obtaining an EIN is straightforward and can be completed online through the IRS website.

To apply for an EIN, you’ll need to fill out Form SS-4, which can be submitted online, via mail, or by fax. The online application process is the quickest method, providing you with an EIN immediately upon completion. Once you have your EIN, you can proceed with other essential steps, such as opening a business bank account and securing necessary licenses and permits.

An EIN is crucial for separating business and personal finances, especially for tax reporting. It ensures that your LLC is recognized by the IRS and can operate legally and efficiently. Obtaining your EIN early in the formation process can help streamline other steps and ensure that your LLC is set up for success.

Opening a Business Bank Account

A separate entity business bank account is essential for maintaining the legal protections of an LLC. It ensures that personal and business finances are kept distinct, which is essential for preserving your liability protection. Mixing personal and business funds can lead to legal complications and jeopardize the limited liability status of your LLC.

Opening a business bank account typically requires documents such as your LLC’s Articles of Organization, EIN, and operating agreement. Additionally, if your LLC operates under a different name, you may need a Business License or Trade Name Certificate. Having these documents ready can streamline the account opening process.

The bank will also require a personal Social Security Number (SSN) for all individuals listed on the account application, and they may verify your information by obtaining a credit report. An EIN is crucial for identification purposes, ensuring that your LLC is recognized as a distinct business entity.

Opening a business bank account is a vital step in managing your LLC’s finances efficiently and maintaining its legal standing.

Securing Business Licenses and Permits

Obtaining the necessary business licenses and permits is crucial for legally operating your LLC. Various types of licenses are issued by federal, state, and local governments, with specific requirements depending on the industry. For example, federal licenses are generally required for industries regulated by the government, such as agriculture and broadcasting.

State licenses are necessary for many businesses and can vary significantly based on the state and industry. Local licenses may include operating permits and health licenses, particularly for establishments serving food or alcohol. Researching how to obtain business licenses for your industry and location ensures compliance.

Certain professions, like accounting and nursing, require specific professional licenses that demonstrate expertise in the field. Additionally, home-based businesses might need occupation permits to comply with local regulations regarding noise and environmental impact.

After obtaining your EIN, you may also need additional registrations, such as a sales tax ID and labor department registration. Consulting local authorities or legal professionals can help ensure that you secure all necessary licenses and permits.

Failing to obtain the required licenses can result in fines and jeopardize your ability to conduct business. Compliance with licensing and permit requirements is essential for setting up your LLC for success.

Maintaining Compliance and Good Standing

Compliance and good standing are vital for the continued operation of your LLC. One of the key requirements is filing annual reports, which provide essential information such as the names and addresses of registered agents and managers, capturing the company’s activities over the past year. The due dates for these reports can vary by state, often aligning with the anniversary of the LLC’s formation.

Not filing an annual report can lead to penalties, loss of good standing, and potential dissolution of the LLC. Additionally, franchise taxes are fees imposed by states for the privilege of having an LLC registered to do business in that state. These recurring costs are part of maintaining your LLC and ensuring its legal operation.

If your LLC operates in multiple states, it must maintain compliance in each jurisdiction. This includes having a registered agent and filing annual reports in each state where the LLC is registered. Failing to register properly in another state can result in hefty fines and penalties. Compliance protects personal assets, ensures legal operation, and reinforces your LLC’s credibility.

Expanding Your LLC to Other States

Registering your LLC as a foreign entity is necessary for expanding to other states. This process requires filing specific documents and paying the state fees applicable in the new state. One of the required documents is often a Certificate of Good Standing from the state where the LLC was originally formed. This certificate verifies that your LLC is in compliance and good standing in its home state.

Each state has its own specific form, often termed Certificate of Authority or similar, which needs to be filed to register the foreign LLC. Additionally, you will need a local registered agent to receive legal documents on behalf of the LLC when operating in the new state. It’s also crucial to verify that your LLC’s business name is available in the new state to avoid conflicts with existing businesses.

After registering, your LLC will need to complete additional registrations with local tax and licensing authorities, depending on your business type. Foreign LLC registration does not create a new entity; it indicates that the existing LLC will conduct business in the new state. This process ensures compliance with local laws and allows your LLC to expand its operations legally and efficiently.

Comparing LLCs to Other Business Structures

Understanding the unique advantages of LLCs is crucial when comparing them to other business structures. Here are some key points to consider:

- Sole proprietorships have minimal paperwork and low startup costs but expose personal assets to risk.

- LLCs provide personal asset protection, keeping business debts separate from personal finances.

- General partnerships similarly do not offer personal liability protection, putting personal assets at risk.

LLCs are taxed on a pass-through basis, meaning that business income is passed through to the members and reported on their personal tax returns. This avoids the double taxation faced by C corporations, where income is taxed at both the corporate and individual levels. S corporations also allow pass-through taxation but come with more restrictions and less operational flexibility compared to LLCs.

C corporations have the advantage of issuing stock, which can be a significant benefit for raising capital. However, they face double taxation and have more regulatory requirements and strict operational structures compared to LLCs. LLCs, on the other hand, offer a more flexible management structure, which can be tailored to the specific needs of the business and its owners.

The flexibility and benefits of LLCs make them an attractive option for many small business owners. LLCs provide limited liability protection, tax advantages, and operational flexibility, making them a versatile and practical choice for many entrepreneurs. Recognizing these differences helps in making an informed decision when choosing the right business structure for your venture.

The Costs Involved in Forming an LLC

Forming an LLC incurs various costs that can significantly vary by state. Filing fees for LLCs typically range from $35 in some states to $500 in others. The average cost to establish an LLC is approximately $129, but this can vary based on the chosen services and state requirements. These fees are necessary to officially register your LLC and obtain the benefits of a limited liability company.

In addition to filing fees, there may be additional costs for services such as expedited filing, registered agents, and compliance. These services can contribute significantly to your business budget, but they also ensure that your LLC is set up correctly and operates smoothly. Factoring these costs into your planning helps avoid any surprises.

Annual maintenance costs for an LLC, such as franchise taxes and compliance fees, typically average around $104. These recurring expenses are part of maintaining your LLC’s good standing and ensuring its ongoing legal operation. Understanding the costs involved in forming and maintaining an LLC can help you budget effectively and ensure the financial health of your business.

Summary

Forming an LLC is a strategic decision that offers numerous benefits, including liability protection, tax advantages, and operational flexibility. By following the steps outlined in this guide, you can navigate the process quickly and efficiently, from choosing a business name to maintaining compliance and expanding your operations. Understanding the nuances of LLC formation empowers you to make informed decisions and set your business up for success.

Maintaining compliance and good management practices are crucial for the continued success of your LLC. Regularly filing annual reports, securing necessary licenses and permits, and keeping personal and business finances separate are essential steps in protecting your LLC’s legal status and credibility. These practices ensure smooth operations and help avoid legal complications.

Starting an LLC is an exciting journey that opens up new opportunities for growth and success. By taking the time to understand the formation process and adhering to best practices, you can build a strong foundation for your business. We hope this guide has provided you with the knowledge and confidence to start your LLC and achieve your entrepreneurial goals.

Frequently Asked Questions

What is a limited liability company (LLC)?

A limited liability company (LLC) is a business structure that offers liability protection for its owners, enabling them to shield personal assets while enjoying flexible management and pass-through taxation. This combination makes it an attractive option for many entrepreneurs.

How do I choose a business name for my LLC?

To choose a business name for your LLC, ensure it is memorable, unique, and compliant with state regulations. Verify its availability in your state’s business database, and consider securing a matching domain name and social media accounts.

What is the role of a registered agent for an LLC?

The registered agent serves as the official contact for your LLC, receiving legal and governmental documents while ensuring compliance with state regulations. It is essential that this agent has a physical address in the state and is accessible during business hours.

What is an LLC operating agreement and why is it important?

An LLC operating agreement is essential as it serves as a contract among members, outlining management structure and operational procedures, thereby preventing disputes. It also ensures legal separation between the LLC and its members, protecting personal assets from business liabilities.

What are the costs involved in forming an LLC?

The costs involved in forming an LLC typically range from $35 to $500 for filing fees, depending on the state, with additional expenses for services and annual maintenance. It is essential to budget for these varying costs to ensure proper formation and compliance.

CHAT WITH US

CHAT WITH US