Essential Guide to LLC Tax Filing: Tips and Requirements

LLC tax filing is essential yet complex, involving specific forms and deadlines. This guide simplifies the entire process, covering classifications, required forms, and important deadlines. You’ll also learn about common mistakes to avoid.

Key Takeaways

- The IRS classifies LLCs based on their membership structure and tax elections, which affect their tax obligations and required filings.

- Filing requirements for LLCs vary by type, with single-member LLCs reporting on personal returns and multi-member LLCs filing partnership returns, while those taxed as corporations must follow different forms.

- Engaging a qualified tax professional can greatly benefit LLC owners by ensuring compliance, optimizing tax benefits, and accurately navigating complex tax regulations.

Understanding LLC Tax Classification

The Internal Revenue Service (IRS) classifies LLCs based on the number of members and the elections made by the entity, which directly impacts their tax obligations. An LLC with at least two members is generally classified as a partnership for tax purposes unless it opts to be treated as a corporation. On the other hand, single-member LLCs are treated as disregarded entities but can elect to be classified as a corporation. This classification is crucial because it determines the specific tax forms that the LLC must file to accurately report income and expenses.

Grasping the IRS’s default designations and the options for corporate tax status is fundamental for LLC members. These classifications affect the type of tax forms required and the overall tax liability, impacting both federal and state obligations.

Default IRS Designations

By default, the IRS classifies single-member LLCs as sole proprietorships for federal income tax purposes. This means that the LLC is disregarded as an entity separate from its owner, and all income and expenses are reported on the owner’s personal tax return using Form 1040 and Schedule C. This can simplify the tax filing process but also subjects the owner to self-employment taxes on the LLC’s income.

For multi-member LLCs, the default classification is as a partnership. This requires the LLC to file Form 1065, which reports the total income and expenses of the business. Each member then receives a Schedule K-1, detailing their share of the income, deductions, and credits, which they report on their personal tax returns.

Knowing these default designations allows LLC members to anticipate their tax obligations and prepare effectively.

Electing Corporate Tax Status

LLCs have the flexibility to elect to be taxed as a limited liability company llc by filing Form 8832 with the IRS. This election allows the LLC to choose either C corporation or S corporation status, depending on the specific needs and goals of the business. Electing C corporation status subjects the LLC to a federal corporate income tax rate of 21% but may lead to double taxation, where income is taxed at both the corporate and individual levels.

Alternatively, choosing S corporation status allows the LLC to function as a pass-through entity, thereby avoiding double taxation. This means that the income, deductions, and credits pass through to the owners’ personal tax returns.

However, an S corporation election requires the LLC to adhere to certain criteria and file Form 2553. After an election is made, an LLC is unable to alter its tax classification. This restriction lasts for a period of 60 months.

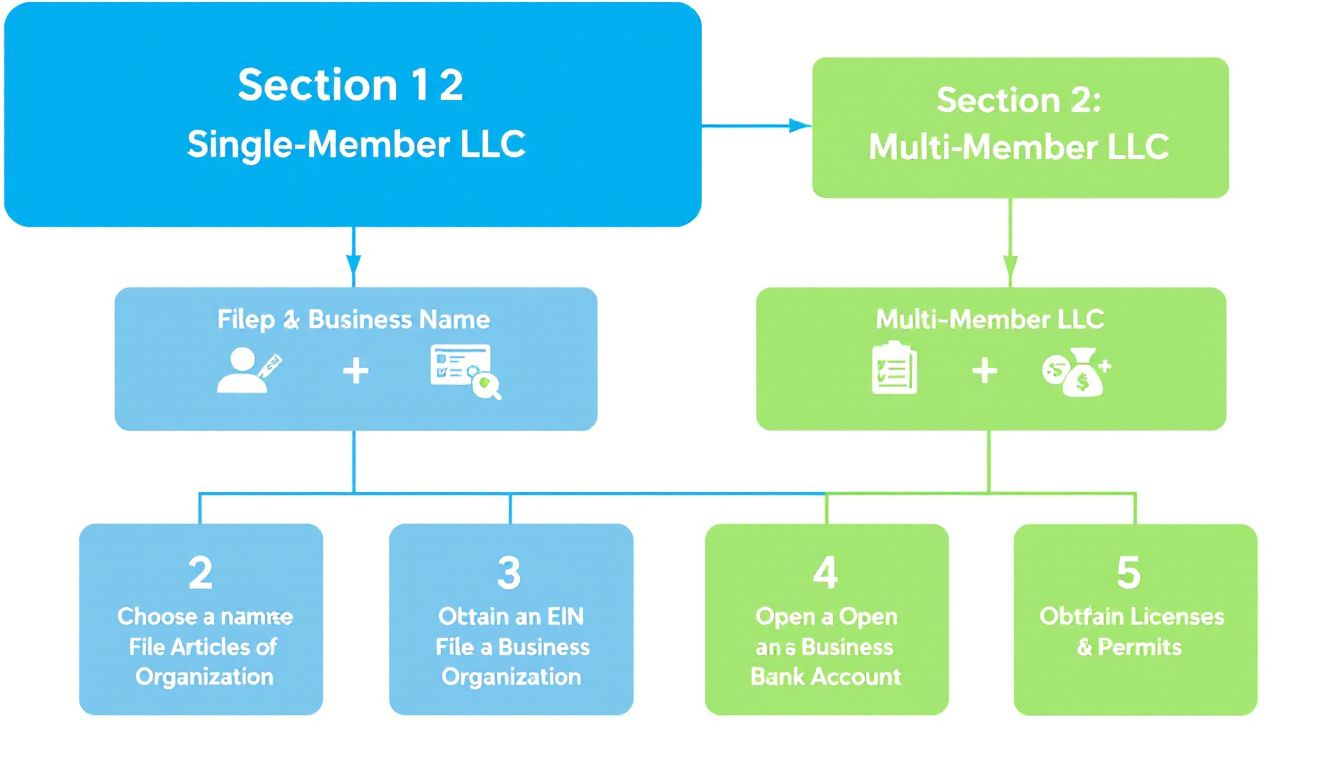

Filing Requirements for Different LLC Types

The filing requirements for LLCs vary significantly based on their tax classification. LLC members are primarily responsible for income tax and self-employment taxes, which can be a major consideration when choosing a tax structure. Under the default classification, LLC owners may also need to make estimated tax payments for their business income throughout the year.

Knowing the specific filing requirements for single-member LLCs, multi-member LLCs, and LLCs taxed as corporations is essential for compliance and avoiding penalties. This includes various returns that may need to be filed with state and local governments.

Single-Member LLCs

Single-member LLCs are taxed as a disregarded entity, meaning they report income directly on the owner’s personal tax return using Form 1040 and Schedule C. This simplifies the filing process but requires the owner to include all business income and expenses on their personal return.

Multi-Member LLCs

Multi-member LLCs must file a partnership tax return using Form 1065, which provides an information report to the IRS detailing the LLC’s total income and expenses. Each member receives a Schedule K-1 by March 15, which details their share of the income, deductions, and credits.

LLCs Taxed as Corporations

LLCs that elect to be taxed as corporations must adhere to different filing requirements. For C corporations, this includes filing Form 1120 to report their income. Income from an LLC taxed as a C corporation is subject to double taxation, requiring both corporate and individual tax filings.

For S corporations, the LLC must file Form 1120S and provide Schedule K-1 to report income to the owners.

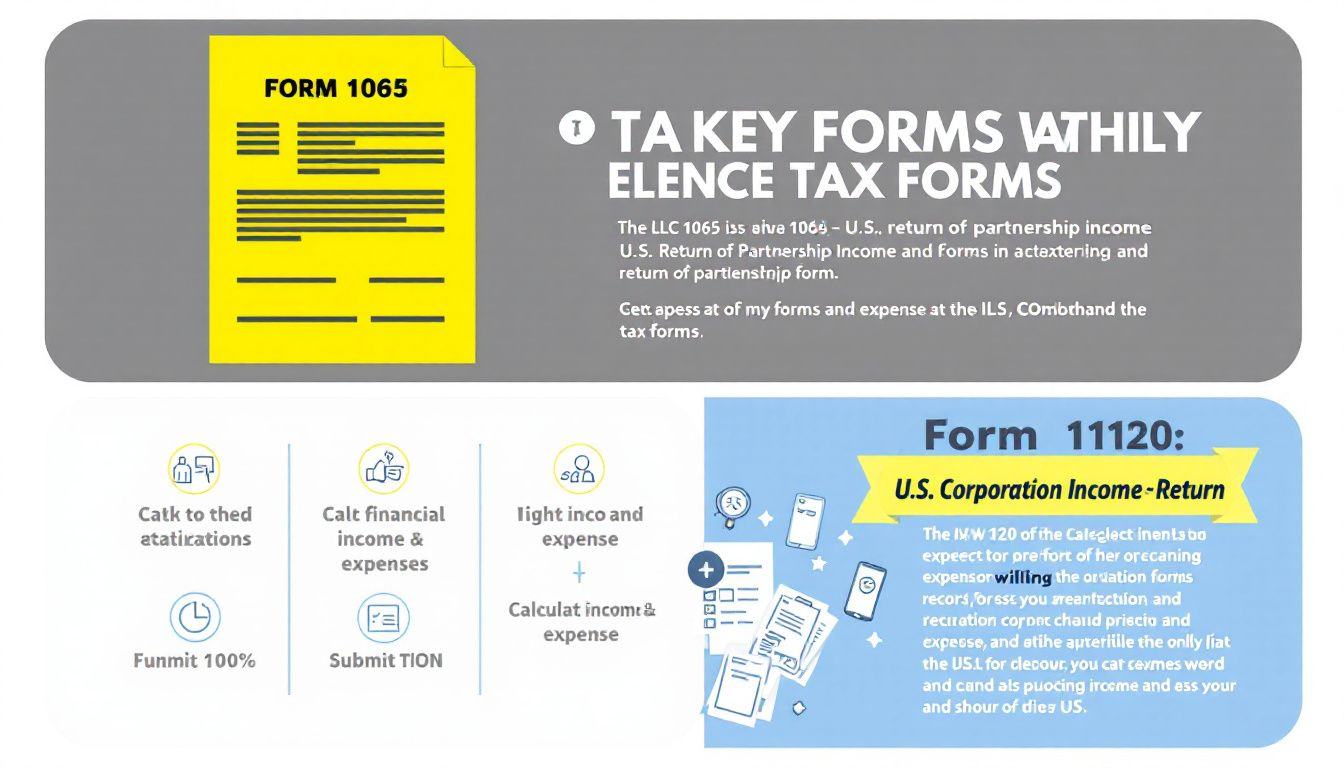

Key Tax Forms for LLCs

Filing the correct tax forms ensures LLCs comply with federal tax regulations. The required forms depend on the LLC’s tax classification, and accurate filing helps avoid penalties and ensures proper reporting of income and expenses.

Form 1065 and Schedule K-1

Multi-member LLCs file Form 1065, which serves as their partnership tax return, reporting the LLC’s total income and expenses. Each member receives a Schedule K-1, detailing their share of the partnership’s income, deductions, and credits, which they report on their personal tax returns.

Form 1120 and 1120S

LLCs taxed as C corporations must use Form 1120 to report their corporate income tax return, detailing their income and deductions for the tax year.

LLCs electing limited liability companies S corporation status file Form 1120S, allowing income to pass directly to shareholders and avoiding corporate taxes.

Schedule C

Single-member LLCs report their business income and expenses on Schedule C, which is attached to their personal tax return, Form 1040. This form details the LLC’s income and deductions, reflecting them directly on the owner’s personal return.

Self-Employment Taxes for LLC Members

Self-employment tax is composed of Social Security and Medicare taxes that self-employed individuals must pay on their earnings. For LLC members, this tax is significant, totaling 15.3% of their net earnings.

Whether an LLC member can draw a salary depends on if they perform services for the business and the tax status of the LLC.

Calculating Self-Employment Tax

LLC members calculate their self-employment tax liability using Schedule SE, which helps determine the amount owed based on net earnings. The Social Security portion of self-employment tax only applies to earnings up to a specified wage base limit, which changes annually.

Strategies to Reduce Self-Employment Tax

One effective strategy to reduce self-employment tax is by electing S-Corp status, which limits the tax to the member’s salary rather than all earnings. By separating salary from profits, LLC members can distribute profits as dividends, which are not subject to self-employment tax.

Additional Tax Obligations for LLCs

In addition to federal income taxes, LLCs may have additional tax obligations such as payroll taxes, sales taxes, federal taxes, and franchise taxes. These obligations are crucial for maintaining compliance and avoiding significant penalties imposed by the IRS for delayed filings.

Payroll Taxes

Payroll taxes encompass mandatory contributions such as unemployment, Social Security, and Medicare taxes. These are required for LLCs that have employees to collect and pay payroll taxes. LLCs must use Forms 940 and 941 to report their payroll tax liabilities, with Form 940 due annually and Form 941 due quarterly.

Sales Taxes

LLCs must collect sales and use taxes when selling taxable goods or services. They are required to register for sales tax purposes and remit the collected tax to the appropriate state or local agency.

Franchise and Property Taxes

Franchise tax is a type of tax that many LLCs must pay in certain states for being allowed to do business in that state.

Not paying franchise tax on time can lead to serious penalties. One possible consequence is administrative dissolution.

Maximizing LLC Tax Deductions

Maximizing tax deductions is crucial for LLCs to reduce their overall taxable income. Claiming capital expenditures, health insurance premiums, and setting up retirement accounts can significantly lower an LLC’s taxable income.

Business Expense Deductions

Deductible expenses for LLCs include office supplies, travel costs, and startup expenses like legal fees. Proper record-keeping is essential for ensuring that all deductible expenses are accurately tracked and reported.

Health Insurance and Retirement Accounts

LLC owners can write off health insurance premiums, provided the business is profitable. Setting up retirement accounts such as SEP-IRA or Solo 401k can further reduce taxable income.

Deadlines and Penalties

Meeting tax deadlines ensures LLCs remain compliant and avoid penalties. Knowing both federal and state tax deadlines helps LLC owners prioritize their tax responsibilities.

Federal Tax Deadlines

For LLCs taxed as sole proprietorships or partnerships, the federal tax return deadline is April 15 each year. Sole proprietorship LLCs must file their taxes using Schedule C on their personal tax returns by April 18, 2023. Partnership LLCs have a filing deadline of March 15, 2023, requiring Form 1065 and Schedule K-1.

LLCs that elect to be taxed as corporations must also file by March 15 annually. Additionally, quarterly estimated tax payments are due on April 15, June 15, September 15, and January 15.

State and Local Tax Deadlines

It is essential for LLCs to check local and state tax deadlines to ensure compliance with all tax obligations. For 2023, the quarterly estimated tax payment due dates for LLCs are April 18, June 15, September 15, and January 16, 2024. Adhering to these deadlines helps LLCs avoid penalties and maintain good standing with state and local tax authorities.

Working with a Tax Professional

Engaging a tax professional can help LLC owners navigate complex tax scenarios effectively. A qualified tax professional, such as a certified public accountant (CPA), can provide guidance on filing statuses that may enhance tax benefits for LLCs. They can also assist in the accurate calculation of Qualified Business Income (QBI) and other complex tax matters.

Choosing the Right Tax Professional

It’s crucial to select a tax preparer with the appropriate credentials and proven experience in LLC taxation. Look for a CPA or tax advisor who specializes in LLC taxation to ensure they are well-versed in the specific tax laws affecting your business.

Checking a tax preparer’s credentials can enhance confidence in their ability to manage LLC tax filings.

Benefits of Professional Assistance

Tax advisors can provide strategic insights, revealing additional tax-saving opportunities for LLC operations. Accurate tax filings help LLCs avoid penalties and legal issues.

Investing in professional tax assistance can ultimately lead to significant financial savings and help you pay tax while promoting business growth.

Summary

Navigating the complexities of LLC tax filing is essential for ensuring compliance and maximizing tax benefits. Understanding the various tax classifications, filing requirements, and key tax forms enables LLC members to make informed decisions about their tax obligations. Additionally, being aware of self-employment taxes and additional tax obligations, such as payroll and sales taxes, helps in comprehensive tax planning.

Working with a tax professional can provide invaluable assistance in navigating these complexities and ensuring accurate filings. By leveraging professional expertise, LLCs can optimize their tax strategies, reduce liabilities, and focus on growing their business. Now equipped with this essential guide, you’re ready to tackle your LLC tax filing with confidence and precision.

Frequently Asked Questions

How are single-member LLCs taxed by default?

Single-member LLCs are taxed as disregarded entities, reporting income directly on the owner’s personal tax return using Form 1040 and Schedule C. This ensures a straightforward tax process for the owner.

What is the filing deadline for multi-member LLCs?

Multi-member LLCs are required to file a partnership tax return (Form 1065) and distribute Schedule K-1 to each member by March 15 annually. Timely compliance ensures proper reporting and fulfillment of tax obligations.

How can LLC members reduce their self-employment tax?

LLC members can reduce their self-employment tax by electing S-Corp status, thereby limiting taxation to their salary instead of all earnings. This strategic choice can lead to significant tax savings.

What forms do LLCs taxed as corporations need to file?

LLCs taxed as corporations must file Form 1120 for C corporations and Form 1120S for S corporations.

Why should LLCs consider working with a tax professional?

LLCs should consider working with a tax professional to effectively navigate complex tax regulations and ensure accurate filings while maximizing available deductions. This collaboration can ultimately lead to significant financial benefits and compliance assurance.

CHAT WITH US

CHAT WITH US